UAE Gratuity Calculator 2026: A Comprehensive Guide

Employees in the UAE are legally entitled to end-of-service gratuity upon termination of their employment. To qualify, several conditions must be met. Therefore, use the UAE end-of-service gratuity calculator to ensure you are fully covered.

Table Of Contents

- 1 UAE Gratuity Calculator

- 2 What is Gratuity in UAE

- 3 How to Use UAE Gratuity Calculator

- 4 Gratuity for UAE Nationals

- 5 Gratuity for Foreigners in the UAE

- 6 Gratuity for Limited Contract Calculation Formula in UAE

- 7 How to Calculate Gratuity in UAE for Unlimited Contract

- 8 Gratuity Calculation Examples in UAE

- 9 Factors affecting the gratuity amount in UAE

- 10 Unpaid Leave Implications for Gratuity in UAE

- 11 Gratuity Rules in UAE

- 12 The Maximum Gratuity in UAE

- 13 Who is Not Eligible for Gratuity in UAE

- 14 Questions & Answers

UAE Gratuity Calculator

Below you can calculate your end-of-service gratuity according to the UAE Labour Law using the following calculator:

What is Gratuity in UAE

End of service gratuity (EOS) in the UAE is a mandatory amount that employers are required to pay to their employees upon termination of their employment. This amount is calculated based on the employee’s length of service and their last basic salary.

How to Use UAE Gratuity Calculator

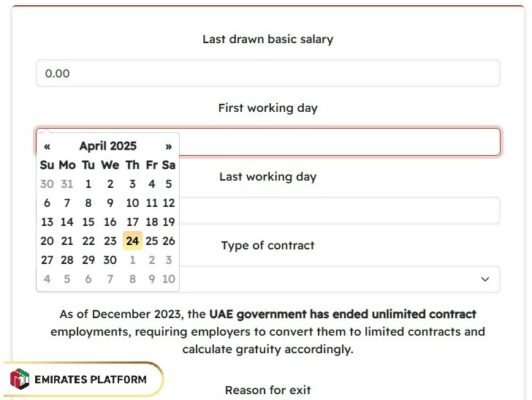

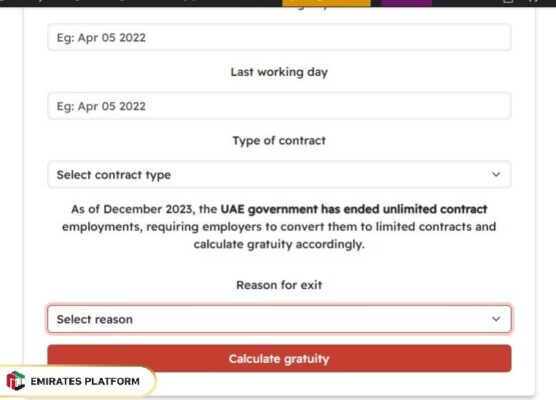

You can use UAE Gratuity Calculator to calculate your end-of-service gratuity online, follow these simple steps:

- Step 1: Input your Last drawn basic salary.

- Step 2: Select your First working day from the calendar.

- Step 3: Select your Last working day from the calendar.

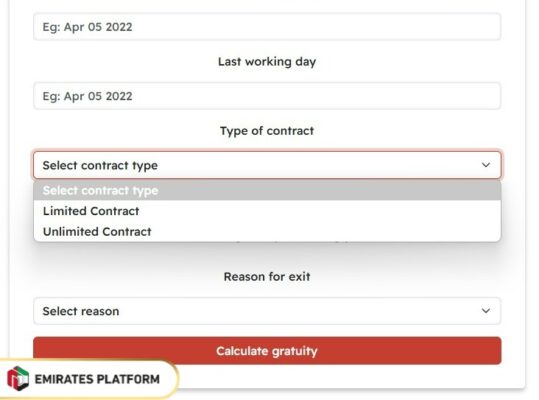

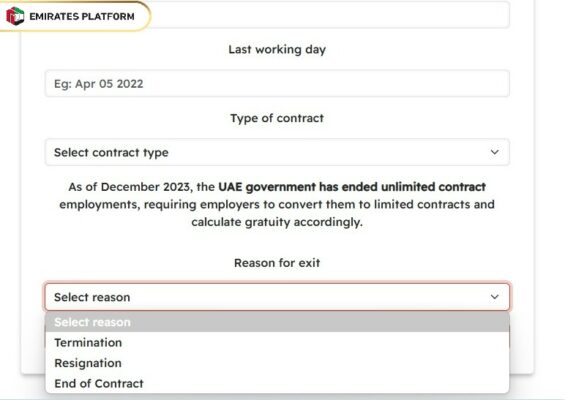

- Step 4: Select the Type of contract from the Dropdown list.

- Step 5: Select the Reason for exit from the Dropdown list.

- Step 6: Click “Calculate Gratuity“.

Gratuity for UAE Nationals

End-of-Service Gratuity is a benefit paid by an employer to an employee. In the UAE, this benefit is calculated based on the employee’s completion of at least one year of service with the company. In this regard, one aspect that must be taken into account is the employee’s status within the company. For example, if the employee is a UAE national, the benefits granted to them in the private sector will be subject to the UAE’s pension and social security laws.

Gratuity for Foreigners in the UAE

For foreign employees, the employer must pay an end-of-service gratuity at the end of their service. This gratuity is paid in a lump sum. The following are the rules for paying end-of-service gratuity to foreign employees:

- Twenty-one days’ salary for each year during the first five years of the employment relationship.

- Thirty days’ salary for each year after the previous period.

- A foreign employee is entitled to calculate this proportional gratuity as a fraction, provided they have completed at least one year of continuous service.

- Unpaid absence days are not counted towards the length of service using the Dubai End of Service Gratuity Calculator.

Gratuity for Limited Contract Calculation Formula in UAE

In the UAE, end-of-service gratuity payment for limited contract employees is calculated according to the following formula:

- Last basic salary × 21 days × number of years of service.

For example, if an employee’s last basic salary was AED 5,000, and they worked for two years, the bonus amount would be as follows:

- AED 5,000 × 21 days × 2 years = AED 210,000

How to Calculate Gratuity in UAE for Unlimited Contract

End-of-service gratuity for employees on unlimited contracts in the UAE is calculated as follows:

- Calculate the employee’s basic salary.

- Calculate the number of years of service the employee has spent with the company.

- Multiply the number of years of service by 21 days of basic pay to calculate the end-of-service gratuity amount.

- Calculate the gratuity by multiplying the number of years of service by one month’s basic pay.

- Add the two amounts together to calculate the employee’s total gratuity amount.

Gratuity Calculation Examples in UAE

- A worker with a basic salary of AED 5,000 and 6 years of service will get:

(21 × 5,000 × 6) ÷ 30 = AED 21,000

- Another example: A person with AED 7,000 basic salary and 10 years of service:

(30 × 7,000 × 10) ÷ 30 = AED 70,000

Factors affecting the gratuity amount in UAE

There are several factors affecting the calculation of the end-of-service gratuity, including the following:

Last Basic Salary

When calculating this bonus, only the employee’s last basic salary before the end of their contract is taken into account. Another point to note is that the basic salary does not include any additional benefits provided by the freelancer.

Type of Employment Contract

There are two types of employment contracts in the UAE: fixed-term contracts and indefinite-term contracts. Therefore, the rules for determining this amount using the UAE End-of-Service Gratuity Calculator vary depending on the type.

Employment Contract Termination

In cases of termination, the following rules apply:

- Employees with between one and five years of service are entitled to 21 days of basic salary.

- Employees with more than five years of service are entitled to an end-of-service gratuity payment of 30 days starting from the fifth year.

Unpaid Leave Implications for Gratuity in UAE

Unpaid leave is a period during which an employee does not receive their regular salary or additional benefits. With this arrangement, this type of gratuity is calculated based on actual days worked. Therefore, unpaid leave can have a direct impact on the final amount of this benefit. For example, if an employee spends a significant portion of their working time on unpaid leave, the amount of their end-of-service gratuity will be reduced accordingly.

Gratuity Rules in UAE

The new UAE Labor Law (Federal Law No. 8 of 1980) and its subsequent amendments define the latest end-of-service gratuity rules in the UAE. The gratuity amount is determined based on length of service as follows:

- If an employee has completed one or more years of service but does not exceed five years, the gratuity is equivalent to 21 days’ wages for each year of service.

- If an employee has completed five or more years of service but does not exceed ten years, the gratuity is equivalent to 30 days’ wages for each year of service.

- If an employee has completed ten or more years of service, the gratuity is equivalent to 45 days’ wages for each year of service.

- The gratuity is calculated based on the employee’s basic salary, excluding any allowances or other benefits such as overtime pay, housing allowance, and health insurance.

The Maximum Gratuity in UAE

The maximum end-of-service gratuity in the UAE is calculated at 21 days of basic salary for each year of service, with a maximum of two years’ salary for those who have completed more than two years of service.

Who is Not Eligible for Gratuity in UAE

In the UAE, the following individuals are not entitled to end-of-service gratuity:

- Employees with less than one year of service

- Non-Emirati employees

- Employees dismissed for disciplinary reasons

- Employees who resigned without prior notice

- Employees who voluntarily terminated their contracts

- Employees on unpaid leave

- Employees working on temporary contracts

Conclusion

UAE labor law requires employers to pay 21 days of their employees’ basic salary for each of the first five years of service, and 30 days for each year thereafter. EOS is calculated by multiplying 21 days by the employee’s last basic salary. To estimate this gratuity, most employees use the UAE EOS calculator.

Questions & Answers

Employees who have served their companies for more than one year but less than five years receive a full end-of-service gratuity, based on the 21st day's salary for each year of service following the first five years.

The formula for calculating the gratuity in the UAE is as follows:

Gratuity = (Basic Salary * Number of Years of Service) / 365

Gratuity = (10,000 AED * 3 years) / 365 = 63,000 AED

The employee’s gratuity is calculated on the basis of the hours they work each week and the length of their services, as follow:

Gratuity = (Basic Salary * Number of Hours Worked per Week * Number of Weeks per Year) / 365

Full-time employees with 5 years of continuous service with one employer.

No, gratuity is not paid to part-time employees in UAE.

No, gratuity is tax-free in the UAE.